Michael was pleased by the measures announced in today's Spring Statement from the Chancellor of the Exchequer.

The strength of the UK’s economy has allowed us to be robust in our response to the crisis in Ukraine, and thanks to our actions, the economy is recovering well from the pandemic with record job vacancies and unemployment back to pre-crisis levels. However, the steps we are taking to sanction Russia are not cost free at home and the situation in Ukraine is having an impact on the cost of living around the world.

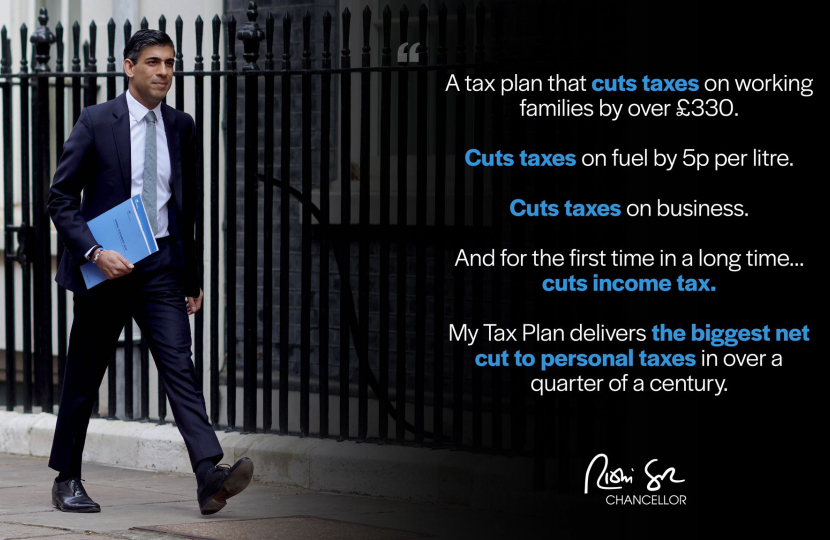

That is why, today we are publishing a new tax plan that will reduce and reform taxes over this Parliament in three ways.

Helping Families with the Cost of Living with £22 billion next year by:

- Slashing fuel duty by 5p for twelve months – a £5 billion tax cut for drivers. This is the largest ever cut across all fuel duty rates.

- Increasing the National Insurance personal threshold by £3,000 from July. This is the largest cut in a starting personal tax threshold in British history and the largest single personal tax cut in a decade.

- Scrapping VAT on energy saving materials for homes such as solar panels and heat pumps– a £250 million tax cut for homeowners. A typical family installing roof top solar panels will save £1,000 on installation and then £300 annually on their energy bills.

- Doubling the existing Household Support Fund to £1 billion - helping a predicted 3 to 4 million vulnerable households with the cost of living.

Creating the Conditions for Private Sector Growth:

- Cutting the tax rates on business investment in the Autumn Budget, boosting capital investment by UK businesses.

- Committing to examine whether the current tax system is doing enough to invest in the right kinds of training.

- Raising employment allowance to £5,000 – a £1,000 tax cut for small businesses

- Committing to reform Research & Development tax credits so they are more effective and better valve for money.

Sharing the Proceeds of Growth Fairly:

- Cutting the basic rate of income tax to 19 pence in 2024, a tax cut worth £5 billion for over 30 million workers, pensioners and savers. This is the first income tax cut for 16 years.

Due to this government’s plan, we can say today: taxes are being cut, debt is falling and investment in public services is growing.

Michael said

"I'm pleased by the support that the Chancellor announced today. Cutting fuel duty is something that many people have raised with me, and it will help with not just the cost of filling up the tank for car owners, but also with the cost of transporting goods which will help everybody. It's also great news that anyone earning less than about £34,000 will pay less in National Insurance, whilst those on higher incomes will pay more"